By Hou Lulu, Yan Huan and Chen Xiaohang from People’s Daily

November is the season to harvest cherries in Chile, where orchard farmers are busy picking the ripe fruit. For Chinese consumers it is only a click away to taste the sweet fruit exported from Chile across the Pacific.

At the same time, more Chinese commodities are making their way into Chilean people’s lives in the Latin American nation, from electronics to automobiles.

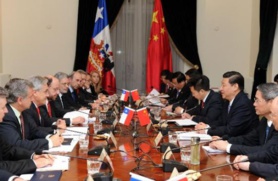

China and Chile have witnessed fast-growing economic and trade cooperation between since a free trade agreement (FTA) was inked in 2006.

Since establishing diplomatic ties 46 years ago, Chile has had a number of ”firsts” in its exchanges with China. For example, it was the first Latin American nation to sign a FTA with China.

Propelled by the agreement, bilateral trade has grown and closer ties have gained momentum.

Trade volume increases fivefold in 10 years

According to the FTA, both countries agreed to adopt a zero-duty policy to cover 97.2 percent of products within a decade. In the second year after the agreement was implemented, the bilateral trade volume increased 66.34 percent. China became Chile’s biggest trade partner the same year and maintains that position today.

According to statistics released by China Customs, bilateral trade reached $31.88 billion in 2015 and Chile has become China’s third largest trading partner in Latin America.

“Bilateral trade is five times what it was 10 years ago. The FTA has brought us considerable economic benefits and a real win-win situation to China-Chile relations,” lauded Luis Schmidt Montes, former Chilean ambassador to China.

The mining industry is a big beneficiary of the bilateral economic and trade cooperation. As China’s economic development creates increasing demands for resources, Chile, with abundant reserves of gold, silver and molybdenum ores, can provide China with metal materials it is in dire need of.

With 30 percent of the world’s reserves, Chile tops the world in copper production and is China’s largest supplier.

A recent report released by the Chilean Copper Commission predicted a flat price, supply and demand of copper in 2017.

Pedro Reus, international director at SOFOFA, an industrial association of Chile, told the People’s Daily that there since is almost no competition between Chile and China in nearly all areas the two economies complement each other, adding that Chile’s industrial sector hopes to beef up cooperation and exchange with Chinese partners in order to improve the living standard of the two countries.

Schmidt stressed that as Chile is shifting its economic model from over-dependence on copper exports and more toward agricultural exports, and that the latter will be a pillar of Chile’s economy in the future.

Agriculture new pillar of bilateral cooperation

Chile is the fourth largest wine exporter in the world. Since a free-tax policy was introduced on wine exported to China, shipments have leapt from 26,000 kiloliters in 2013 to 154,000 kiloliters in 2015. Chile is now the second largest wine exporter to China and China’s largest bulk wine provider.

According to staff of Vina Concha y Toro, a famous wine producer in Chile, wines made from the Cabernet Sauvignon variety is most favored by Chinese consumers and it is also the grape most planted in its vineyards.

Cristian Lopez, the President of the Asia-Pacific branch at Vina Concha y Toro, said that his company deems the Chinese market its most important priority, adding that thanks to the FTA, the less expensive Chilean wines are more cost-effective for Chinese consumers.

He said that the company only exported 100 cases of wine in the 1990s, but now it exports tens of thousands of cases per year.

Besides wine, fruit from Chile are popular among Chinese consumers. Thanks to a high quality and policy dividends brought by FTA, Chile’s exports of fruit like blueberries and cherries have dramatically increased in recent years. In 2004, Chile only exported 0.4 percent of its domestic-produced fruits to China, but the proportion rose to 16.6 percent in 2014.

“Driven by the rapid development of the Chinese economy, its middle class are seeking green food of high quality. China’s need for food points the way for Chile’s economic reform, and agriculture will be a new front for bilateral cooperation,” Schmidt underlined.

He added that as one of the world’s largest producers of fruit, wine, pork and poultry, Chile plans to grow into the largest food exporter in a decade.

Huge potential in investment

“Though China’s investment in Chile is less than in Brazil and Peru, there is great potential in the future,” Reus stated, showing his confidence in bilateral cooperation.

By the end of 2015, the stock of non-financial foreign direct investment from China in Chile reached $203 million.

Heraldo Munoz, Minister of Foreign Affairs in Chile, echoed that many sectors have great potential for attracting Chinese investment, citing the construction of a tunnel linking Chile and northern Argentina as an example.

When Chile began to assess bidders for the construction of the Agua Negra tunnel in October, it also looked forward to the participation of Chinese enterprises in this corridor connecting the Pacific and Atlantic, the minister said.

Chinese enterprises have seen their chances in the Chilean market. In Iquique, an important port city in north Chile, Zhejiang Dahua Technology Co., Ltd. (Dahua) have installed and put into use 250 laser monitoring systems.

Since it entered the Chilean market in 2013, Dahua has increased its local annual sales from $1 million to $10 million, emerging from a company only offering video surveillance to a solution provider with a variety of products. Its sales channels have also diversified, covering cooperative projects with public and private investment.

Fu Liquan, founder of Dahua said that as a leader in the local safety equipment market, in terms of sales volume the firm has obtained a host of big contracts. “We are bullish on the Chilean market,” he said.

Fu promised that his company would introduce more products and technologies, improve its competitiveness and ultimately contribute more to security and safety in Chile and even in Latin America.

A series of Chinese companies like Huawei have grown into pillars in the Chilean telecommunication industry with their outstanding performances, Reus pointed out, advising Chilean and Chinese enterprises to communicate more on marketing strategies, recruitment and employees, so that Chinese enterprises could better adjust to the local investment environment and reinforce bilateral investment cooperation as a result.

Chinese investment in agriculture, mining and finance in Chile has soared in recent years, and the room for future investment in such areas will continue to rise, commented Francisco Silva, President of China-Chile Bilateral Business Council, adding that such investment will bring more welfare to the two countries.

November is the season to harvest cherries in Chile, where orchard farmers are busy picking the ripe fruit. For Chinese consumers it is only a click away to taste the sweet fruit exported from Chile across the Pacific.

At the same time, more Chinese commodities are making their way into Chilean people’s lives in the Latin American nation, from electronics to automobiles.

China and Chile have witnessed fast-growing economic and trade cooperation between since a free trade agreement (FTA) was inked in 2006.

Since establishing diplomatic ties 46 years ago, Chile has had a number of ”firsts” in its exchanges with China. For example, it was the first Latin American nation to sign a FTA with China.

Propelled by the agreement, bilateral trade has grown and closer ties have gained momentum.

Trade volume increases fivefold in 10 years

According to the FTA, both countries agreed to adopt a zero-duty policy to cover 97.2 percent of products within a decade. In the second year after the agreement was implemented, the bilateral trade volume increased 66.34 percent. China became Chile’s biggest trade partner the same year and maintains that position today.

According to statistics released by China Customs, bilateral trade reached $31.88 billion in 2015 and Chile has become China’s third largest trading partner in Latin America.

“Bilateral trade is five times what it was 10 years ago. The FTA has brought us considerable economic benefits and a real win-win situation to China-Chile relations,” lauded Luis Schmidt Montes, former Chilean ambassador to China.

The mining industry is a big beneficiary of the bilateral economic and trade cooperation. As China’s economic development creates increasing demands for resources, Chile, with abundant reserves of gold, silver and molybdenum ores, can provide China with metal materials it is in dire need of.

With 30 percent of the world’s reserves, Chile tops the world in copper production and is China’s largest supplier.

A recent report released by the Chilean Copper Commission predicted a flat price, supply and demand of copper in 2017.

Pedro Reus, international director at SOFOFA, an industrial association of Chile, told the People’s Daily that there since is almost no competition between Chile and China in nearly all areas the two economies complement each other, adding that Chile’s industrial sector hopes to beef up cooperation and exchange with Chinese partners in order to improve the living standard of the two countries.

Schmidt stressed that as Chile is shifting its economic model from over-dependence on copper exports and more toward agricultural exports, and that the latter will be a pillar of Chile’s economy in the future.

Agriculture new pillar of bilateral cooperation

Chile is the fourth largest wine exporter in the world. Since a free-tax policy was introduced on wine exported to China, shipments have leapt from 26,000 kiloliters in 2013 to 154,000 kiloliters in 2015. Chile is now the second largest wine exporter to China and China’s largest bulk wine provider.

According to staff of Vina Concha y Toro, a famous wine producer in Chile, wines made from the Cabernet Sauvignon variety is most favored by Chinese consumers and it is also the grape most planted in its vineyards.

Cristian Lopez, the President of the Asia-Pacific branch at Vina Concha y Toro, said that his company deems the Chinese market its most important priority, adding that thanks to the FTA, the less expensive Chilean wines are more cost-effective for Chinese consumers.

He said that the company only exported 100 cases of wine in the 1990s, but now it exports tens of thousands of cases per year.

Besides wine, fruit from Chile are popular among Chinese consumers. Thanks to a high quality and policy dividends brought by FTA, Chile’s exports of fruit like blueberries and cherries have dramatically increased in recent years. In 2004, Chile only exported 0.4 percent of its domestic-produced fruits to China, but the proportion rose to 16.6 percent in 2014.

“Driven by the rapid development of the Chinese economy, its middle class are seeking green food of high quality. China’s need for food points the way for Chile’s economic reform, and agriculture will be a new front for bilateral cooperation,” Schmidt underlined.

He added that as one of the world’s largest producers of fruit, wine, pork and poultry, Chile plans to grow into the largest food exporter in a decade.

Huge potential in investment

“Though China’s investment in Chile is less than in Brazil and Peru, there is great potential in the future,” Reus stated, showing his confidence in bilateral cooperation.

By the end of 2015, the stock of non-financial foreign direct investment from China in Chile reached $203 million.

Heraldo Munoz, Minister of Foreign Affairs in Chile, echoed that many sectors have great potential for attracting Chinese investment, citing the construction of a tunnel linking Chile and northern Argentina as an example.

When Chile began to assess bidders for the construction of the Agua Negra tunnel in October, it also looked forward to the participation of Chinese enterprises in this corridor connecting the Pacific and Atlantic, the minister said.

Chinese enterprises have seen their chances in the Chilean market. In Iquique, an important port city in north Chile, Zhejiang Dahua Technology Co., Ltd. (Dahua) have installed and put into use 250 laser monitoring systems.

Since it entered the Chilean market in 2013, Dahua has increased its local annual sales from $1 million to $10 million, emerging from a company only offering video surveillance to a solution provider with a variety of products. Its sales channels have also diversified, covering cooperative projects with public and private investment.

Fu Liquan, founder of Dahua said that as a leader in the local safety equipment market, in terms of sales volume the firm has obtained a host of big contracts. “We are bullish on the Chilean market,” he said.

Fu promised that his company would introduce more products and technologies, improve its competitiveness and ultimately contribute more to security and safety in Chile and even in Latin America.

A series of Chinese companies like Huawei have grown into pillars in the Chilean telecommunication industry with their outstanding performances, Reus pointed out, advising Chilean and Chinese enterprises to communicate more on marketing strategies, recruitment and employees, so that Chinese enterprises could better adjust to the local investment environment and reinforce bilateral investment cooperation as a result.

Chinese investment in agriculture, mining and finance in Chile has soared in recent years, and the room for future investment in such areas will continue to rise, commented Francisco Silva, President of China-Chile Bilateral Business Council, adding that such investment will bring more welfare to the two countries.

Menu

Menu

China, Chile on the fast track for economic and trade cooperation

China, Chile on the fast track for economic and trade cooperation